MANAGEMENT ISN’T WHAT IT USED TO BE. And that just might be the understatement of the century. Every single executive, entrepreneur, manager and employee out there — without exception — must recognize that the century-old traditional management system has become obsolete. Going forward, every organization will be digital. Companies — even entire industries — will be disrupted and destroyed; but at the same time, new market space and enormous economic opportunity is being created.

It takes a new kind of organization to thrive in this environment, and we believe Amazon personifies the new formula for winning in the digital age. Its management system breaks new ground in six key ways:

BUILDING BLOCK 1: A Customer-Obsessed Business Model

Despite their espoused commitment to putting the customer first, most traditional companies tend to be competition-centric. They pay a huge amount of attention to financial results, especially earnings per share, and dance to the quarter-by-quarter short-term rhythm set by the capital market. In contrast, Amazon’s business model is customer-obsessed; continuously expanding; built on novel concepts of platform, ecosystem and infrastructure; and able to defy traditional laws of diminishing returns — all while delivering increasing cash flows and higher return on investment.

BUILDING BLOCK 2: A Continuously Bar-Raising Talent Pool

Most traditional companies spend enormous amounts of money and effort in recruiting, developing, and retaining talent, and yet still encounter huge difficulty in finding the right people and deploying them in the right jobs. Amazon’s talent pool is carefully defined, meticulously documented, and rigorously chosen. This is coupled with complete end-to-end follow-through and feedback to ensure continuous bar-raising, both for the talent pool itself and for the self-reinforcing mechanism of talent acquisition and retention.

Amazon’s data and metrics system is ultra-detailed, cross-silo, real-time, input-oriented and AI-powered.

BUILDING BLOCK 3: An AI-Powered Data and Metrics System

In most companies founded ‘pre-digital’, data is scattered and fragmented within different silos, layers, and business units producing significant latency of weeks and months. People seeking a full picture of what is really happening from day to day must spend intensive efforts involving many people. Amazon leverages modern technology to run day-to-day operations differently: Its data and metrics system is ultra-detailed, cross-silo, cross-layer, end-to-end, real-time, input-oriented and AI-powered. Everything can be tracked, measured, and analyzed in real time, with anomalies detected, insights generated, and routine decisions automated.

BUILDING BLOCK 4: A Ground-Breaking Invention Machine

Before Amazon, most companies built their success on one brilliant innovation they made a long time ago. After that superlucky and destiny-defining moment, many shied away from ground-breaking inventions, and seemed complacent with minor improvements here and there, year after year — sometimes limited to only the packaging. Amazon’s invention machine is continuous, accelerating, and aimed at generating groundbreaking, game-changing, and customer behaviour-shaping inventions.

BUILDING BLOCK 5: High-Velocity and High-Quality Decision Making

With legacy management systems, decision-making happens at what feels like a glacial pace. Myriad frustrations litter a typically lengthy approval process composed of numerous executives and committees and decision are further stalled by all kinds of politics, gaming-the-system, and the routine charades of maximizing requests on resources, and minimizing commitments on results.

Amazon’s decision-making is high-quality, high-velocity, and strictly follows a set of clearly-articulated principles and uniquely designed toolsets enforced with striking consistency throughout the organization.

BUILDING BLOCK 6: A Forever Day-1 Culture

As they get bigger, most legacy companies find they have long lost the initial speed, agility, and vitality commonly found in start-ups. They become rigid, slow, and risk-averse as complacency and bureaucracy creep in. Some can sustain for a while. Others will gradually fall into oblivion or irrelevance. And some will become the prey for aggressive acquirers. Only a few will continuously refresh themselves. Amazon is committed to being ‘Forever Day-1’ — that is, to combining the size and scale advantages of a big company with the speed and agility of a start-up.

In this article we will take a deep dive into Amazon’s business model. For interested readers, all six building blocks are discussed in detail in our book [The Amazon Management System: The Ultimate Digital Business Engine That Creates Extraordinary Value for Both Customers and Shareholders].

The Business Model That Changed Everything

By 2019, Amazon had become a digital giant beyond most people’s wildest imagination. In an interview with CNBC, Charlie Munger, Warren Buffet’s decades-long partner, described it as “a phenomenon of nature.” Following are the core principles of its business model.

CUSTOMER OBSESSION. From the beginning, CEO Jeff Bezos has rarely finished a speech or an interview without talking about customers. The first principle that he stated in his famous nine-point management and decision-making approach was, “We will continue to focus relentlessly on our customers.” Among the company’s 14 leadership principles, customer obsession ranked number 1 when Amazon started out in 1997 and has remained at the top ever since.

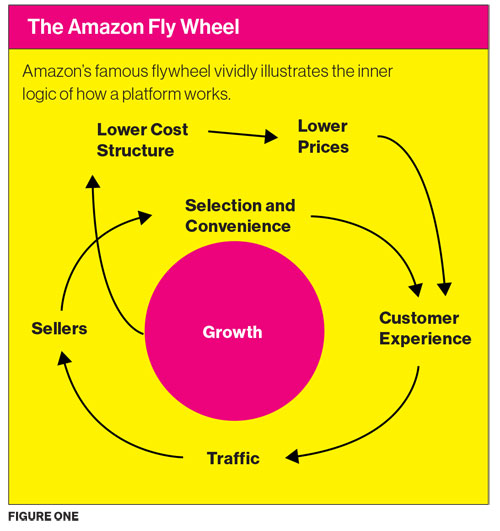

Bezos regards customers as Amazon’s most valuable asset, so it is no surprise that they are a central piece in the company’s famous ‘flywheel’ (see sidebar). Despite Amazon’s booming business, Bezos remains constantly in awe of customers:

“There is no rest for the weary. I constantly remind our employees to be afraid, to wake up every morning terrified. Not of our competition, but of our customers. Our customers have made our business what it is. They are the ones with whom we have a relationship, and they are the ones to whom we owe a great obligation. And we consider them to be loyal to us –— right up until the second that someone else offers them a better service.”

Customer trust is an earned privilege, not a long-term benefit to be taken for granted. It takes years to build, seconds to break, and forever to repair. That’s probably why Bezos has emphasized, “Our pricing objective is to earn customer trust, not to optimize short-term profit dollars.”

Invent for Customers. How can a company not just meet but stay ahead of customers’ ever-rising expectations? The only way to do this is through continuous innovation and relentless invention. The divinely discontent customer has become the source of continuous inspiration for Amazon’s invention machine. As Bezos put it, “One thing I love about customers is that they are divinely discontent. Their expectations are never static: they go up. It’s human nature.”

Many traditional companies also pay serious attention to innovation and improvement, but they normally do so because of competitive or performance pressure. They may seek marginal iterations around the edges, making tweaks here and there, especially to packaging, but rarely do they make systematic overhauls for completely new ideas.

At Amazon, the relentless drive to invent dramatic new ways to delight customers never ends. Unlike traditional companies that primarily use technology for cost reduction, Amazon focuses on using technology to totally transform the existing customer experience, and to imagine an experience that does not yet exist. Take Kindle. It was never meant to ‘out-book’ the book; it was designed instead to have new capabilities impossible with the traditional book, such as having millions of titles on sale, finding a book and having it in 60 seconds, being able to underline passages and create notes and saving them in the cloud.

In the spirit of relentless drive to invent, Amazon has single-handedly created entirely new markets with huge global potential, such as cloud services (AWS) and smart speakers (Echo). As Bezos has pointed out:

“No one asked for AWS. No one. Turns out the world was in fact ready and hungry for an offering like AWS but didn’t know it. We had a hunch, followed our curiosity, took the necessary financial risks, and began building — reworking, experimenting, and iterating countless times as we proceeded.”

Long-Term Thinking. “It’s all about the long term,” noted Bezos in his inaugural letter to shareholders, adding, “a fundamental measure of our success will be the shareholder value we create over the long term.”

Why is long-term thinking so important for Amazon? The secret lies in the very nature of its business model. Amazon is all about platform and infrastructure. So it is, in essence, a scale business characterized by high fixed costs and relatively low variable costs.

Building platform and infrastructure takes multiple years and requires massive investments of billions or dozens of billions, if not more. From a short-term perspective, be it quarterly, annually or a two to three-year timeframe, such investments will never be able to generate enough return to cover the initial investments, not to mention generating return. Only those who can think at least seven to ten years out are able to fully recognize the innate beauty of the platform and infrastructure business: the flywheel, the self-reinforcing mechanism and the exponential growth tilted towards the long term.

So, how to drive the return on such a massive investment? Scale and speed really matter here. Bezos’s Letters to Shareholders up to the time of this writing constantly reinforce this philosophy. First is scale. Increasing scale “spreads fixed costs across more sales, reducing cost per unit, which makes possible more price reductions.” Once the scale passes a certain threshold, what Bezos calls the “tipping point,” it “allows us to launch new ecommerce businesses faster, with a higher quality of customer experience, a lower incremental cost, a higher chance of success, and a faster path to scale and profitability than any other company.”

That’s why in his first letter to shareholders, Bezos stated “We will balance our focus on growth with emphasis on long-term profitability and capital management. At this stage, we choose to prioritize growth because we believe that scale is central to achieving the potential of our business model.”

Second is speed. Platform and infrastructure are a technology game. Prior investments and faster movements captivate a larger customer base earlier, and accumulate historical data earlier, which translates into significant first-mover advantages in data analytics, algorithm enhancements and AI driven solutions. In short, all these elements combined create Amazon’s digital core competencies.

Because of its digital core competency, Amazon can continuously improve its operational efficiency while lowering its cost structure, becoming ever more competitive in serving millions more customers. Such faster iterations of continuous improvements create steep — and increasingly higher — entry barriers for latecomers.

Amazon has consistently and massively invested gross margin cash into technology.

Earnings vs. Cash Generation. Many people have been baffled by Amazon, which has long been on the verge of barely breakeven, but has enjoyed an unbelievable leap forward in terms of market valuation. Those who assume that it is unprofitable or makes little profits are unequivocally mistaken, because the most relevant metric in the digital age is cash earnings per share, not EPS (earnings per share). Unlike the fixed asset investment by traditional companies that can be categorized as CapEx (capital expenditure), and thus depreciated over a multi-year timeframe, many of the investments into the digital tools, systems, and platforms can only be categorized as OpEx (operational expenditure), and thus listed as expenses of the current year, thus lowering the net earnings. Such investments are essential to achieve 25 per cent per year growth.

Amazon’s track record disproves this misunderstanding and removes every single shred of delusion that digital giants will falter because they are not making money in terms of net income. When they achieve appropriate scale, these companies are massive cash machines.

Why this focus on cash flows, especially gross margin cash generation? As a Wall Street veteran, Bezos fully understands that “a share of stock is a share of a company’s future cash flows, and, as a result, cash flows more than any other single variable seem to do the best job of explaining a company’s stock price over the long term.”

Bezos has walked the talk, and the capital market has rewarded him. Let’s do the math together. In 2018, Amazon made US$ 232.9 billion in revenue. At a gross margin of 40.25%, this translates into $93.7 billion in gross margin cash generation in one year alone. From the operating cash flow point of view, Amazon generated $30.7 billion in net cash from operations in 2018.

However, instead of leaving this enormous cash as profits on its financial statement, Amazon has been consistently and massively investing gross margin cash into technology ($28.8 billion in R+D expenses), platform and infrastructure ($13.4 billion in capital expenditure) to fund its exponential scaling.

| |

|

| |

Amazon’s Leadership Principles

1. Customer obsession. Leaders start with the customer and work backwards. They work vigorously to earn and keep customer trust. Although leaders pay attention to competitors, they obsess over customers.

2. Ownership. Leaders are owners. They think long term and don’t sacrifice long-term value for short-term results. They act on behalf of the entire company, beyond just their own team. They never say “that’s not my job.”

3. Invent and simplify. Leaders expect and require innovation and invention from their teams and always find ways to simplify. They are externally aware, look for new ideas from everywhere, and are not limited by “not invented here.” As we do new things, we accept that we may be misunderstood for long periods of time.

4. Leaders are right a lot. But not always. Leaders are right a lot. They have strong judgment and good instincts. But they also seek diverse perspectives and work to disconfirm their own beliefs.

5. Learn and be curious. Leaders are never done learning and always seek to improve themselves. They are curious about new possibilities and act to explore them.

6. Hire and develop the best. Leaders raise the performance bar with every hire and promotion. They recognize exceptional talent, and willingly move them throughout the organization. Leaders develop leaders and take seriously their role in coaching others.

7. Insist on the highest standards. Leaders are continually raising the bar and drive their teams to deliver high quality products, services, and processes. Leaders ensure that defects do not get sent down the line and that problems are fixed so they stay fixed.

8. Think big. Thinking small is a self-fulfilling prophecy. Leaders create and communicate a bold direction that inspires results. They think differently and look around corners for ways to serve customers.

9. Bias for action. Speed matters in business. Many decisions and actions are reversible and do not need extensive study. We value calculated risk taking.

10. Frugality. Accomplish more with less. Constraints breed resourcefulness, self-sufficiency, and invention. There are no extra points for growing headcount, budget size, or fixed expense.

11. Earn trust. Leaders listen attentively, speak candidly, and treat others respectfully. They are vocally self-critical, even when doing so is awkward or embarrassing. They benchmark themselves and their teams against the best.

12. Dive deep. Leaders operate at all levels, stay connected to the details, audit frequently, and are skeptical when metrics and anecdote differ. No task is beneath them.

13. Have backbone; disagree and commit. Leaders are obligated to respectfully challenge decisions when they disagree, even when doing so is uncomfortable or exhausting. Leaders have conviction and are tenacious. They do not compromise for the sake of social cohesion. Once a decision is determined, they commit wholly.

14. Deliver results. Leaders focus on the key inputs for their business and deliver them with the right quality and in a timely fashion. Despite setbacks, they rise to the occasion and never settle.

|

In closing

Everything Amazon has done or will do is based on its core principles: customer obsession, a relentless drive to invent, long-term thinking, and the prioritization of cash generation. The company’s remarkable consistency to these principles from day one has positioned it to create an historic variety of businesses at a global scale.

To conceive a business model is one thing; to get it up and running and continuously evolving is another. Countless intriguing business plans, impressive blueprints and brilliant game-changing ideas never hit the road, or fail to deliver. Why is the Amazon leadership team able to pull this off? Many business leaders and entrepreneurs are super strong and devoted to the business, but have neither the will nor the skill in organizational management. Bezos has the rare combination of a visionary leader and a down-to-earth builder obsessed with the organization and how it should be run. He is the mastermind behind the design of Amazon’s digital management system, and also the field marshal who forcefully and personally drives the enforcement. Why so much effort personally? Because Bezos knows too well that without the right management system, even the best business model won’t fly.

Ram Charan is a world-renowned advisor to CEOs, business unit managers and boards of directors. He earned MBA and doctorate degrees from Harvard Business School. His latest book is

The Amazon Management System: The Ultimate Digital Business Engine That Creates Extraordinary Value for Both Customers and Shareholders (Idea Press Publishing, 2019), from which this article is an adapted excerpt. Co-author

Julia Yang was previously a consultant at McKinsey and a private equity investor at Bain Capital. She serves on the faculty of the joint MIT-Tsinghua MBA program.

This article appeared in the Winter 2020 issue. Published by the University of Toronto’s Rotman School of Management, Rotman Management explores themes of interest to leaders, innovators and entrepreneurs.

Share this article: