There is still a lot of confusion around terms like cryptocurrency and blockchain. Can you provide a quick primer?

A cryptocurrency is a digital or virtual currency that is secured by cryptography — which makes it nearly impossible to counterfeit. ‘Cryptos’ allow for secure online payments that are denominated in terms of virtual ‘tokens’, holding the promise of making it easy to transfer funds directly between two parties without the need for a trusted third party like a bank or credit card company. Unlike traditional currency, cryptos are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

Blockchains are an essential component of many cryptocurrencies. These are cryptographically protected distributed ledgers made up of ‘blocks’ that contain transaction history. As the blockchain grows longer and longer, it becomes increasingly difficult to alter older transactions, ensuring the integrity of transactional data.

There are two main types of cryptocurrencies. The first are essentially tokens or ‘digital stickers’ that run on a platform. The only thing that can be done with them is to shift them around. Examples include Bitcoin, Dogecoin and Litecoin. The second type of cryptocurrency is used as a built-in payment and rewards system for blockchain networks. In return for using these tokens, you receive a computational service. An example of this is Ethereum, which is a decentralized, opensource blockchain. Ether is the native cryptocurrency of this platform, and after Bitcoin, it is the second-largest cryptocurrency by market capitalization.

Not everyone is a fan of cryptocurrency. Many believe that its value is merely based on the opinion of others. How do you react to this view?

I’m not a fan of Bitcoin or the other digital stickers, either. No one can truthfully say that they have any intrinsic value other than what people are willing to pay for them. However, you can make a much stronger case for the cryptocurrency that is used in Ethereum, because it can be used to obtain computational services. And in the future, when you move to the so-called Proof of Stake system, you can potentially receive rewards based on your holdings. So down the road, cash flows could emanate from some of these tokens.

How are Bitcoin and other cryptocurrencies used?

A cryptocurrency ‘wallet’ stores private and public keys, which are necessary to send and receive coins. There are hardware, software and paper wallets. Hardware and paper wallets are typically

considered more secure than software wallets, although there are pros and cons associated with each.

Some merchants accept Bitcoin and other cryptocurrencies directly from a user’s wallet. Even though some of them have very high prices, they are divisible into very small fractions. Bitcoin, for example, is divisible down to a ‘satoshi’, which represents 0.00000001 of one Bitcoin. Some companies have created ATMs where you can use U.S. dollars and other traditional currencies to buy Bitcoin and sell them to get cash. There are also companies that have created debit and credit cards where you can convert Bitcoin or other cryptocurrencies into dollars and use them just like you would any other payment card. But in all honesty, Bitcoin itself is used mainly for speculation. The set of use cases is limited. Blockchain networks like Ethereum and others, however, provide a host of functionality that many companies — particularly start-ups — are embracing.

Tesla has invested US$1.5 billion in Bitcoin. It recently ditched Bitcoin payments, but at press time, remains its second-largest corporate holder. Is this a smart move?

If I was a shareholder of Tesla, I would be very annoyed, because I bought shares of an electric car manufacturer, and now it is making investments on my behalf. If I wanted exposure to Bitcoin, I would buy Bitcoin. I don’t need the car company that I invested in doing that. Of course, it’s good for Bitcoin, because over the last year we’ve seen a lot of institutional money flow into it, which makes people believe that it’s not going to drop to zero overnight. In my mind, Elon Musk should be focusing on his business and not on playing with his investors’ money.

Huge companies like Microsoft and Coca-Cola are also embracing cryptocurrencies. Should all businesses be doing this?

I think businesses should definitely consider what services and benefits they can obtain from blockchain technology. The way to think about a blockchain is that it is a common resource for value transfers. What that means is, you can use blockchains to conduct transactions, foreign exchange operations, escrow, trading, or bidding for contracts. There are many things you can organize using these joint networks. And clearly, massive value can come from working on common platforms — as we have seen with the Internet.

The Internet is really a large open infrastructure, and it’s obviously very valuable for the exchange of information. Blockchain networks are essentially trying to be the same thing for value transfers. If you can organize major portions of your supply chain or your accounting system with these open networks, that could potentially be very valuable, because you could save costs and make payments more efficient and transparent. In my view, the most valuable aspect of all of this is the common network and its functionality.

Your Rotman colleague, Finance Professor Lisa Kramer, recently said that it’s unwise for businesses to accept cryptocurrencies in exchange for goods and services. Do you agree?

I think it’s unwise for any business not to accept a proposed means of payment, because in doing so, a deal could fall through. At the same time, if you do decide to accept cryptocurrencies in some form, you should do it smartly. For instance, Paypal offers a service for people to pay with cryptocurrencies, but the merchant actually receives fiat currencies, so it is not exposed to the crypto risk.

If you think about it, Canadian businesses have accepted U.S. dollars for a long time, even though U.S. currency is not legal tender in Canada. So if you can find a way to accept cryptocurrencies and make a deal happen where otherwise it wouldn’t happen, why not? Having said that, Lisa is absolutely right in saying that businesses, especially small ones, should not hold cryptocurrencies. So there is a smart way to do it and a not-so-smart way.

What about the big banks? Do you foresee a day when cryptocurrency is integrated into our financial system?

There are certainly big questions around the banks, with different entities offering different services nipping at their heels. As indicated, I see Blockchain networks as a common infrastructure that allow value transfers across a wide spectrum. At the moment, our financial infrastructure is extremely siloed. The payment network is prohibitively slow: If you send money from a savings account at CIBC to an investment account at TD, it takes at least two days for the funds to arrive. That makes no sense in the modern world, when everything else is instantaneous.

Clearly, massive value can come from working on common

platforms — as we have seen with the Internet.

With a blockchain, you could trade assets on different platforms. Say you want to buy some options on the Montreal Exchange and stocks on the Toronto Stock Exchange. They all live on different ledgers, so it’s a really complicated process to reconcile all of that. And God forbid if you want to do anything across borders. If a common resource was available for all of these transactions, it would be very valuable. Imagine if all securities could live on a common platform and be pooled. That would be extremely valuable for the functioning of markets. Conceptually, there are huge potential efficiency gains and cost savings if this is deployed properly.

The big question is, If the world moves to an open platform, what will be the role of banks? Bank leaders need to think carefully about this. It’s not so much a question of how they can integrate

blockchain into their current processes; it’s more about what role banks will play if and when the world moves in this direction. What new products can they offer and what would become redundant? How can they ensure their relevance and survival?

Will we start to see large enterprises hiring talent that specializes in this area?

Yes. First of all, because new services will emerge. If we move to decentralized platforms — which I hope we will, because there is value in doing that — then new service providers will emerge to help firms navigate the system. And of course, you will need people in your finance or accounting department who are able to interface with these service providers and understand what is going on. There are significant opportunities on the horizon that will require lots of learning and re-learning for the organizations that embrace these opportunities.

It has been said that China is currently developing its own digital currency. What are the implications of this?

Central-bank-issued digital currencies are an emerging issue and a completely different beast from cryptocurrencies. Central-bank issued currencies are digital representations of fiat currencies — government money — and we will definitely see them proliferate in the future. China is basically developing a digital representation of the yuan that lives on a particular network.

Remember, China is light years ahead of the West in terms of digital payments with Alipay and WeChat Pay. Those two apps alone make up 90 per cent of its payments market. They are extremely efficient and user friendly, which will make it difficult for the digital yuan to compete directly with them. As a result, China will likely apply some form of pressure for people to use it or for Tencent and Ant Group to include it in their services. Personally, I am concerned about the power that Tencent and Ant Group can amass with the payments data that they collect. Currency and Banking Databases also raise a lot of questions about privacy of information and the stability of banks when people move deposits into central bank digital currencies. At the same time, existing electronic bank payments are also very expensive for consumers and merchants. There is a very strong case that people should have an option to participate in the digital economy. All of this is a huge area of interest these days.

You serve as a mentor for the Creative Destruction Lab’s Blockchain Stream. How is the stream unfolding so far?

The Blockchain Stream at CDL Toronto brings together experienced entrepreneurs, economists and active investors to help scale ventures based on technologies underpinned by, or core to the advancement of, blockchain technology. The start-ups attend an intensive two-week virtual ‘crypto-economics bootcamp’ in July, instructed by industry and academic leaders in blockchain

and crypto-economics, followed by five objective-setting sessions between October and the following June.

The stream has been active for three years now, and it’s been fascinating to see it evolve. When it first started, there was a lot of skepticism around blockchain. People really didn’t know what to make of it. In the second year, it got pretty depressing, because we were in the midst of a ‘crypto winter’. Everyone was asking, ‘Is this going to go anywhere?’ But since the fall of 2020, there has been enormous excitement about the blockchain movement, in particular about the area of decentralized finance and about the ventures themselves. CDL participants aren’t really interested in crypto prices and all the hype. Nobody is working on Bitcoin or, God forbid, Dogecoin. Our CDL participants are doing serious work to advance the field and they (and I!) are more excited about the blockchain functionalities that are becoming available and the opportunities that they are unlocking.

What does a typical start-up look like in this stream?

There is such a wide variety. To give you an idea, here are some examples of alumni of the program: AdHash is a protocol for trading advertising placements via real-time bidding; Biconomy is an application programming interface that enables decentralized apps (dapps) to improve the speed of transaction completion and end-user experience; Carbon Block is a hardware and software solution to produce verified carbon credits; and Lake Project’s portfolio recommendation engine makes investing in digital assets simple, building diversified portfolios for users and automatically rebalancing them based on market trends. That is a sample of what we have seen so far. But the

innovation has just begun.

Andreas Park is a Professor of Finance at the University of Toronto, appointed to the Rotman School of Management and the Department of Management at UTM. He is the Research Director at FinHub, Rotman’s Financial Innovation Lab, the co-founder of the LedgerHub, the University’s blockchain research lab, a lab economist for blockchain at the Creative Destruction Lab, the economic advisor to Conflux Network, and a consultant to the OSC and IIROC. He recently co-authored a design proposal for a central-bank issued digital currency, commissioned by the Bank of Canada.

Deconstructing the Digital Goldrush

By Kunal Sawhney |

|

Generations of Finance and Economics students have learned about fiat currencies—government-issued currencies that are not backed by a physical commodity such as gold or silver, but rather, by the government that issues them. There are currently around 180 such currencies in the global marketplace, including the U.S. and Canadian dollars, the euro and the Chinese yuan.

With fiat currencies, the country’s central bank guarantees the currency’s value: A $100-bank note is backed by the central bank’s promise to pay 100 dollars to the bearer. But cryptocurrencies are very different—and their proponents believe that this difference is what justifies their utility.

Digital currencies are not regulated by any central bank, or for that matter, by any authority whatsoever. They do away with so-called intermediaries—despite the fact that in the real world, it is these very intermediaries that infuse confidence in a currency as a method of payment. Cryptocurrencies don’t fit the definitions of ‘money’, ‘asset’ or ‘investment instrument’. Instead, they can be exchanged on a peer-to-peer network with transactions recorded on blockchain technology.

Currency plays a vital role in every nation’s external trade. According to the U.S. Treasury Department, if any country deliberately influences the exchange rate to gain an unfair competitive advantage over other exporters, it amounts to currency manipulation. For example, a government may attempt to keep its currency weaker than the U.S. dollar, making its exports cheaper for overseas buyers. In August 2019, the U.S. accused China of being a currency manipulator, using the yuan to gain an unfair advantage in trade. If predictions come true and cryptocurrencies become universally accepted in global trade, currency manipulation will become a thing of the past.

During recessionary phases, countries print money to infuse liquidity into the market. When a nation’s currency falls against the U.S. dollar, the central bank starts selling dollars to support the local currency. The fact that no one authority regulates cryptocurrencies makes them invulnerable to manipulation — but it also means that if the global economy falls into a recession, crypto cannot be printed (or in this case, mined) to infuse liquidity in an economy, nor can it be purchased or sold to support any other currency.

Following are some other reasons to be cautious about cryptocurrency.

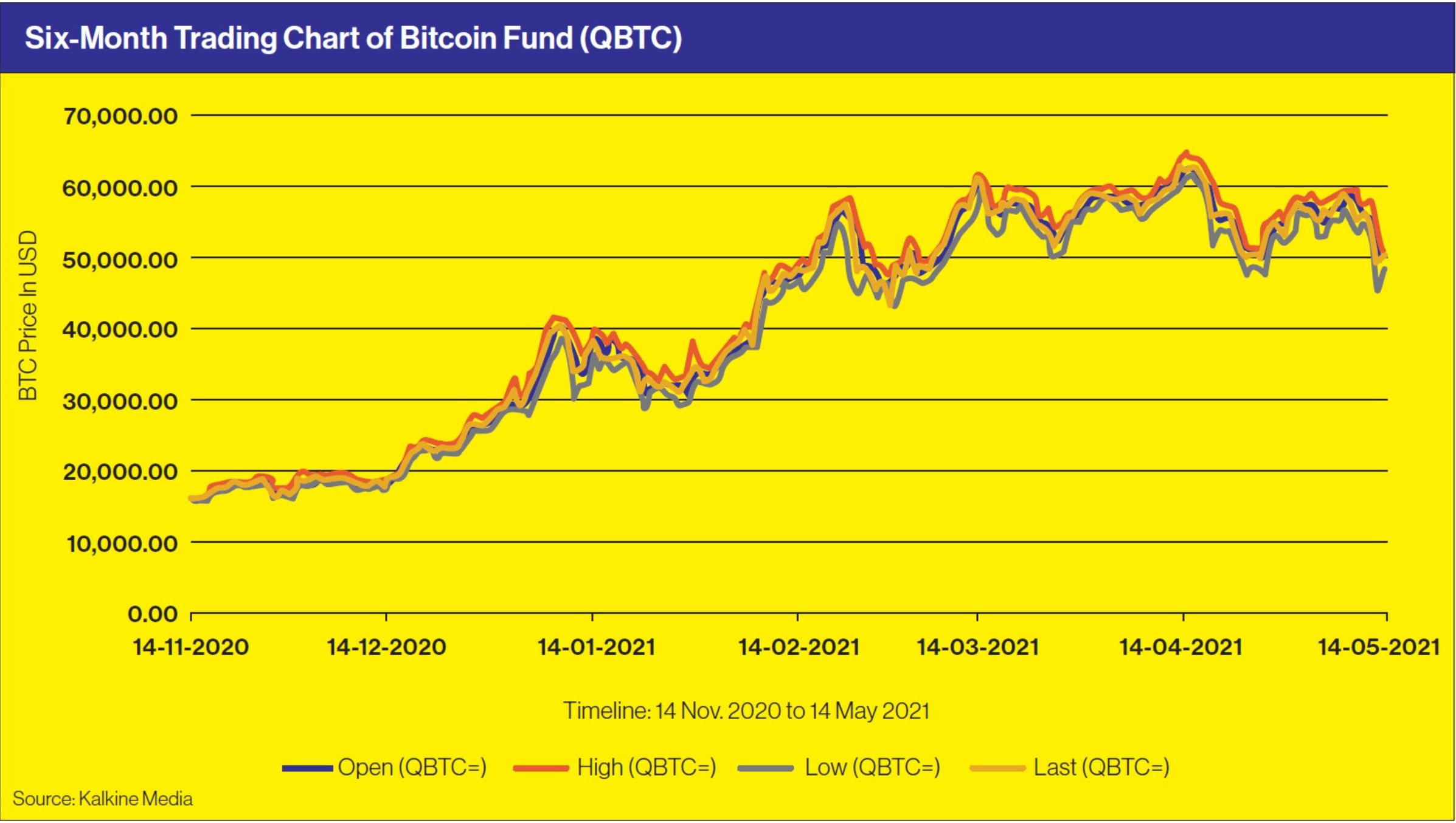

EXTREME VOLATILITY IS THE NORM. In April 2021, the total market value of digital currencies breached the US$2-trillion mark, with Bitcoin—the most popular cryptocurrency—accounting for over 50 per cent. At that time, the price of one Bitcoin token more than doubled on a year-to-date basis, breaching US$60,000 at one point.

Whereas a 15 to 20 per cent rise or fall in prices has become the new normal in the crypto space, such fluctuations would signal a market crash or a record bull run in the stock market space. Figure One (above) depicts the volatility of Bitcoin in recent months.

In May 2021, the frenzy around cryptos compelled the S&P Dow Jones to launch new indices to track the movement in prices of the currencies underpinning them. In April 2021, Canada approved three Ethereum exchange traded funds (ETFs)—a move that followed approval of the world’s first Bitcoin ETF two months earlier. These ETFs invest directly in physically settled digital currencies instead of futures or derivatives. These ETFs bestow validity to the ‘reimagined’ currencies, allowing investors a safe path to invest in cryptos apart from directly buying or selling them via exchanges like Coinbase, Kraken and Binance.

THERE ARE NO CHECKS AND BALANCES. The ‘positive’ features of digital currencies are also the areas of concern. When currencies were introduced in the days of kingdoms with rulers, there were no central banks to exercise oversight. Questions arose as to how much money should be minted or printed? Will the same minted coin be acceptable tomorrow in case the kingdom sees a change of sovereignty? Which authority will be answerable for any disturbances? The doubts never allowed those copper and gold coins to become sustainable. Checks and balances were not a want; they were a need.

Multilateral organizations, including the World Trade Organization, the World Bank, the International Monetary Fund, the G7 and the United Nations owe their existence to this need. The world, torn after devastating wars, needed economic, financial, legal, political and social stability. Oversight authorities bring transparency and predictability to any field. Thanks to them, one knows where to report a theft, where to report financial fraud, or where to report misguiding statements in an IPO prospectus. But at least for now, such checks and balances are non-existent in the crypto world.

The glittering world of digital currencies, where crypto exchange platforms such as Nasdaq-listed Coinbase and news sites like CoinDesk outshine their traditional market peers, is a world of many ‘ifs’. For instance, what if a multibillionaire, who recently called a digital currency ‘the future of transactions’, calls it a not-as-promising asset than some other new entrant?

A LACK OF UTILITY. Factories produce goods that have or can have demand in the market. This demand is a product of the utility of that good. Price is a factor of the cost of production and demand and supply forces. More demand and less supply results in a price increase. This statement holds some value in the case of cryptocurrencies, too. From multibillionaires to large portfolio investors, the demand for cryptocurrencies is relatively high. Supply depends on the complex mining process. Prices, as a result of these forces, have breached many unthinkable targets. Do cryptos have any true utility? The answer may lie in some distant future.

HIGH ELECTRICITY CONSUMPTION. A sizeable portion of the world’s energy generation capacity still comes from power stations using coal as fuel. Annual electricity consumed for cryptocurrency mining dwarfs the total energy consumption of countries like Argentina.

Experts say this indefensible electricity consumption might be the straw that breaks the camel’s back. Similarly, investing in other valuable resources in the crypto space, from human capital to costs involved in setting up new indices and trading platforms, is irrational until digital currencies prove their utility.

NO INVESTOR PROTECTION. Traditional investment instruments include shares of corporations, fixed deposits with banks and so on. The common thread is an underlying entity that lends credibility to the instrument. Stocks represent a company that undertakes an economic activity to generate profit. Authorities like the Canadian Securities Administrators (CSA) or the U.S, Securities and Exchange Commission (SEC) work to prevent any unscrupulous act by an entity listed on the exchange. Deposits with banks, too, have an element of trustworthiness, given that these financial institutions are the backbone of any economy.

Cryptocurrencies are not like any of these investment instruments. Investments in these digital currencies have indeed generated millions in profits, but investing in this ‘new and reimagined’ currency is laden with excessive risks. In May 2019, hackers stole US$41 million worth of Bitcoin in a cyber heist from crypto exchange Binance. The exchange “begged for users’ understanding”, but there was no authority like the CSA or the SEC to step in to ensure investor protection.

So, why are cryptocurrencies so popular? Enter the concept of marketing. Marketing is a powerful tool to drive demand and, thereby, the price of any entity. In the age of digital marketing, a single tweet from a multibillionaire CEO can boost or decrease the market value of anything, including cryptocurrency.

From Reddit to Twitter, social media platforms are shaping investors’ sentiments like never before. Elon Musk’s tweets in May 2021 favouring Dogecoin over Bitcoin led the former’s price to surge and the latter’s to crash. What if more countries like Turkey crack down on cryptocurrencies? What if more crypto exchanges like Turkey’s Vebitcoin and Thodex suddenly go offline and cease all trading? What if India bans cryptocurrencies? There are many more such questions.

Powerful marketing strategies and creative promotional campaigns can infuse believability in superficial concepts. For example, Ponzi schemes rely solely on marketing and brand building. And when multimillionaires and large corporates lend a hand to these campaigns, there is no stopping the stampede of FOMO investors. The game completely changes when retail investors enter the scene. Such investors don’t have a lot at stake individually. However, together as a segment, they risk the most. Seasoned investors are well aware of the underlying risks in marketing-backed instruments, and hence, they hedge such positions.

The popularity of cryptocurrencies is similar. Investors are rushing to add them to their portfolios, and some are making profits. But all such gains are a product of further bets by some new investors at an enhanced price (i.e. greater fool theory.) Capital, however, is a limited resource. Governments need to fund their welfare schemes and private players cannot bet indefinitely on cryptos. One can buy a digital currency for, say, $1; another can buy it for $2, allowing a dollar in profit to the first buyer. But unless subsequent buyers find some utility that justifies a price tag above $2, the entire scheme loses steam.

The global economy is currently reeling from many factors, including trade wars, geopolitical tensions and the COVID-19 pandemic. If we were in the midst of a boom period, deploying massive resources to a yet-unproven technology might be justifiable. But with governments finding it difficult to maintain fiscal prudence due to increased spending on welfare programs and limited private investment scope, resources going towards the crypto space call for greater scrutiny at this time.

Kunal Sawhney is the founder and CEO of Kalkine Media, which provides a holistic view of stock investment recommendations to retail investors with respect to financial performance, strategy and industry catalysts. Based in Sydney, Australia, he is featured regularly on Sky Business, CNBC and Australian Financial Review.

|

Share this article: